Building a diversified investment portfolio is one of the most important strategies for managing risk while maximizing returns.

A well-diversified portfolio helps protect investors from market volatility by spreading investments across various asset classes, industries, and geographical regions.

Whether you are an experienced investor or just starting, diversification plays a crucial role in ensuring that your financial goals are met while minimizing potential losses.

In today’s rapidly changing financial landscape, relying on a single investment avenue can be risky.

Economic downturns, market fluctuations, and unforeseen events can significantly impact the value of investments.

By carefully distributing assets across multiple categories, investors can cushion the effects of market instability and enhance their chances of consistent growth.

Additionally, diversification allows investors to take advantage of various market opportunities, reducing the reliance on any single investment for returns.

In this comprehensive guide, we will delve deep into the steps required to build a well-balanced and diversified investment portfolio, covering everything from asset allocation to risk assessment and rebalancing strategies.

Whether your objective is long-term wealth creation, retirement planning, or passive income generation, this guide will help you create an investment strategy that aligns with your financial aspirations.

Understanding the Importance of Diversification

What is Diversification?

Diversification is an investment strategy that involves spreading your capital across various asset classes, industries, and geographic regions to reduce risk.

The idea behind diversification is to ensure that the negative performance of one asset does not significantly impact the overall portfolio.

By holding a mix of investments that react differently to market conditions, investors can achieve a balanced risk-to-reward ratio.

Why is Diversification Important?

- Risk Reduction: Spreading investments across multiple asset classes minimizes exposure to market volatility.

- Steady Returns: A diversified portfolio can provide more consistent returns over time.

- Protection Against Market Crashes: Investments in different sectors and regions reduce the impact of downturns in any single market.

- Maximizing Growth Opportunities: Diversifying into different industries allows investors to capitalize on growth in various sectors.

- Inflation Protection: Certain asset classes, such as commodities and real estate, act as hedges against inflation.

- Currency Risk Management: International diversification helps protect against currency fluctuations.

Common Pitfalls of Not Diversifying

Investors who fail to diversify their portfolios often face significant risks. Relying too heavily on a single asset class, such as stocks or real estate, can lead to substantial financial losses if that sector underperforms.

A lack of diversification can also result in missed opportunities for growth in other markets.

Moreover, emotional investing—where investors panic-sell during downturns—can be mitigated with a well-balanced portfolio.

Without diversification, a single economic downturn, technological disruption, or geopolitical event could wipe out significant portions of an investor’s wealth.

ALSO READ: How to Choose the Best Blogging Platform for Beginners

Step By Step Guide to Build a Diversified Investment Portfolio

Step 1: Set Clear Investment Goals

Before diving into investments, it is crucial to establish clear financial goals.

Your investment strategy should align with your objectives, whether they are short-term, medium-term, or long-term.

Identifying Your Investment Goals

- Wealth Growth: If you aim for capital appreciation, consider stocks, ETFs, and mutual funds.

- Passive Income: Investments in bonds, dividend stocks, and rental properties generate regular income.

- Retirement Planning: A mix of stocks, bonds, and retirement funds ensures a stable future.

- Emergency Fund: Keeping a portion of your assets in liquid investments provides financial security in times of crisis.

- Tax Efficiency: Investing in tax-advantaged accounts can enhance after-tax returns.

- Socially Responsible Investing (SRI): Aligning investments with ethical or environmental values.

Assessing Risk Tolerance

Risk tolerance varies among investors based on their financial situation and personal preferences.

Investors should determine whether they are:

- Conservative: Prefer low-risk investments like bonds and fixed deposits.

- Moderate: Willing to invest in a mix of stocks and bonds.

- Aggressive: Seek high returns through stocks, cryptocurrencies, and emerging markets.

By understanding your financial goals and risk appetite, you can create an investment strategy tailored to your needs.

Step 2: Asset Allocation Strategies

Asset allocation is the process of distributing investments across different asset classes to balance risk and reward.

The right allocation depends on factors such as age, income, and financial objectives.

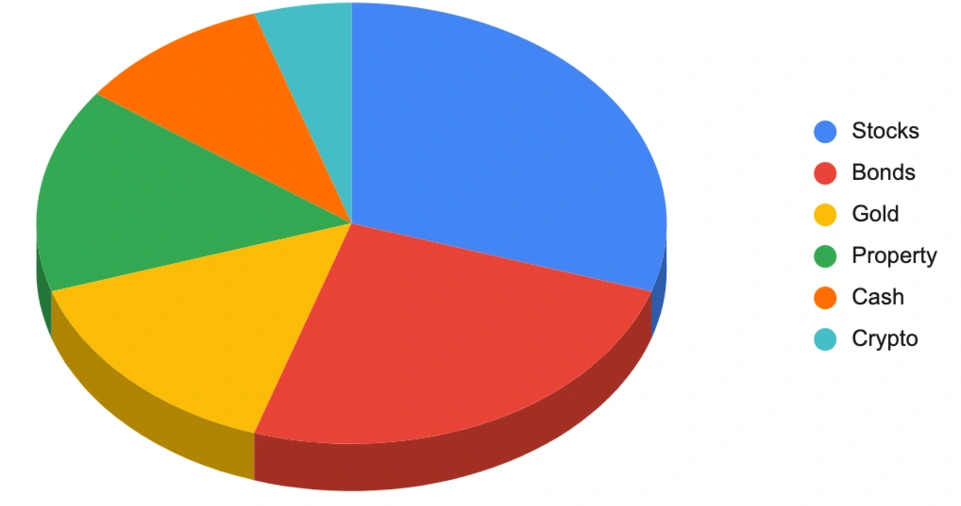

Major Asset Classes

- Stocks (Equities): Provide high returns but come with greater volatility.

- Bonds: Offer stability and regular income with lower risk.

- Real Estate: Provides long-term appreciation and rental income.

- Commodities (Gold, Oil, etc.): Act as a hedge against inflation.

- Cryptocurrency: High-risk but offers significant growth potential.

- Mutual Funds & ETFs: Offer diversification within a single investment.

- Alternative Investments: Private equity, hedge funds, and collectibles can add diversity.

Recommended Asset Allocation Based on Age

- Young Investors (20s-30s): 70% Stocks, 20% Bonds, 10% Others

- Middle-Aged Investors (40s-50s): 50% Stocks, 40% Bonds, 10% Others

- Retirees (60s+): 30% Stocks, 50% Bonds, 20% Others

A well-balanced asset allocation ensures that investors are neither overly exposed to risk nor missing out on growth opportunities.

Step 3: Diversify Within Asset Classes

Diversification goes beyond asset allocation; it also involves selecting different investments within each asset class.

Stock Market Diversification

- Invest in Different Sectors: Spread investments across technology, healthcare, finance, and consumer goods.

- Large-Cap, Mid-Cap, Small-Cap Stocks: A mix of company sizes balances risk and reward.

- Domestic vs. International Stocks: Global investments reduce country-specific risk.

- Growth vs. Value Stocks: Combining high-growth and undervalued stocks enhances returns.

Bond Market Diversification

- Government Bonds: Low-risk, stable returns.

- Corporate Bonds: Higher yield but more risk.

- Municipal Bonds: Tax-free income opportunities.

- Short-Term vs. Long-Term Bonds: Provides flexibility in different interest rate environments.

Real Estate Diversification

- Residential Properties: Suitable for rental income.

- Commercial Properties: Long-term lease agreements provide stability.

- REITs (Real Estate Investment Trusts): Allows investors to own real estate without direct management.

Step 4: Geographical Diversification

Investing in different geographical regions protects against local economic downturns.

Why Invest Internationally?

- Economic Growth Variations: Some regions grow faster than others.

- Currency Diversification: Reduces dependence on a single currency.

- Different Market Cycles: Countries experience market fluctuations at different times.

- Access to Emerging Markets: Developing economies offer high-growth opportunities.

ALSO READ: How to Market Your Business on Social Media Effectively

Conclusion

Building a diversified investment portfolio is key to long-term financial success.

By setting clear investment goals, allocating assets strategically, diversifying within and across asset classes, and rebalancing periodically, investors can minimize risks and maximize returns.

Whether you’re investing for retirement, passive income, or wealth accumulation, a well-diversified portfolio ensures financial stability in an unpredictable market.

Understanding risk tolerance, leveraging geographical diversification, and staying informed about economic trends further strengthen your financial position, ensuring sustained growth and stability.